Description

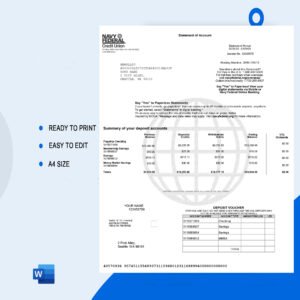

Citibank Bank Statement Template

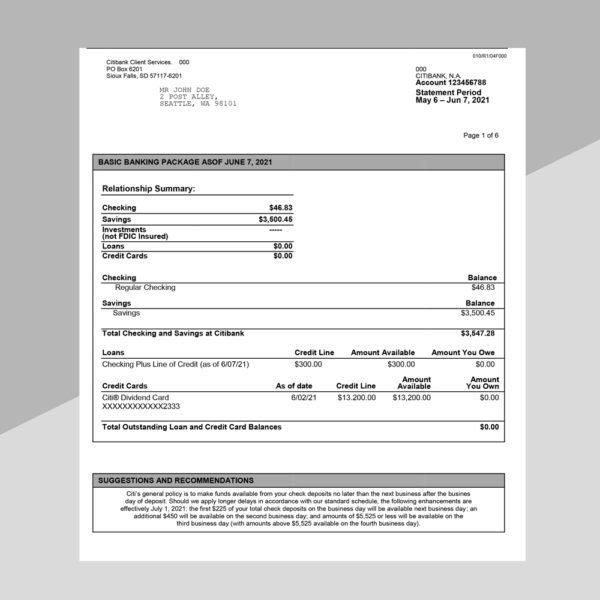

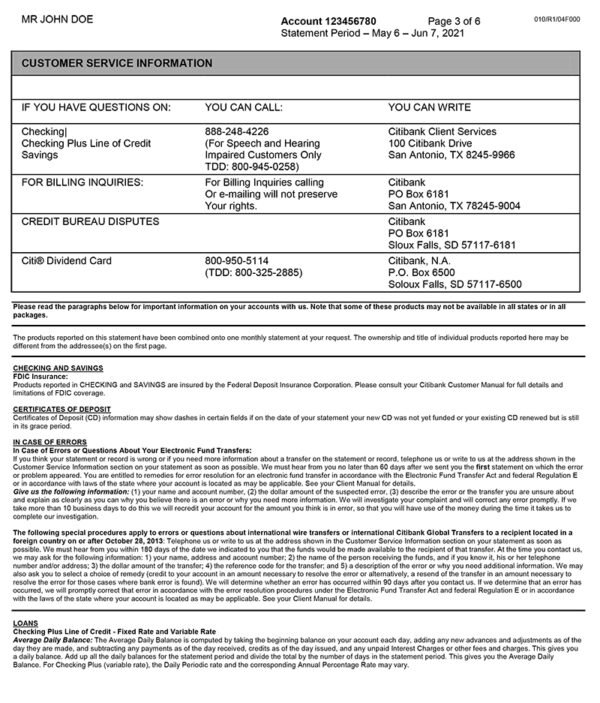

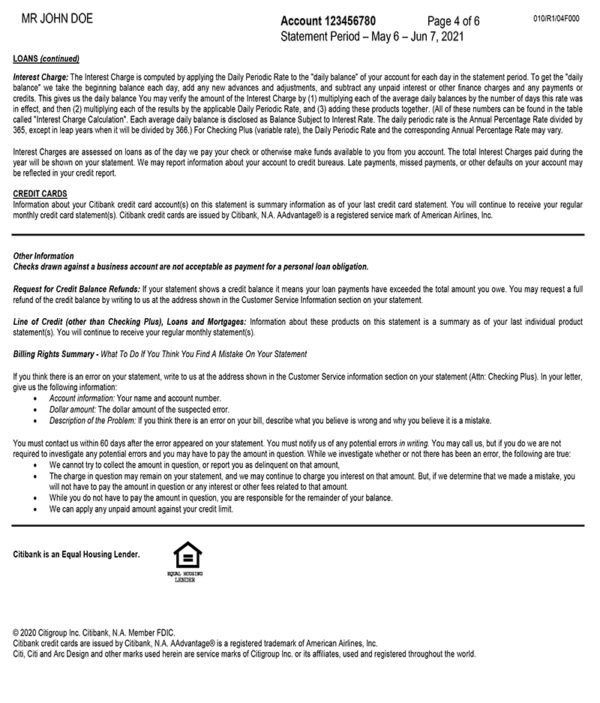

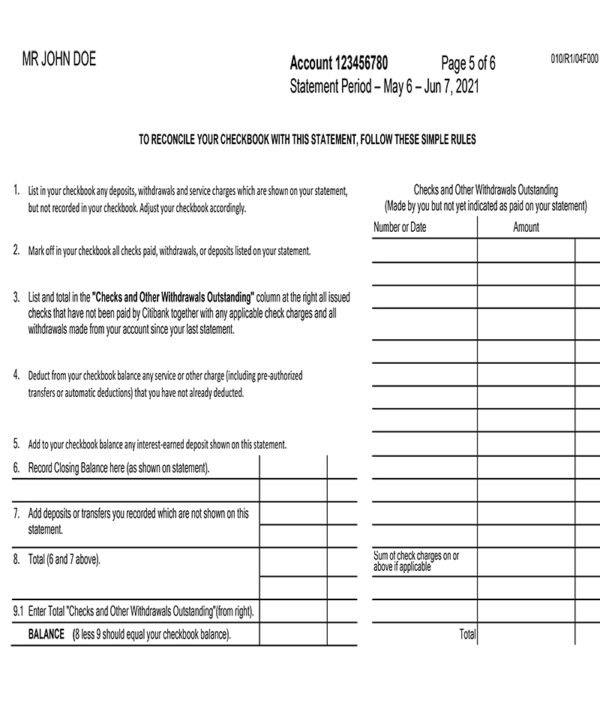

A bank statement template is a pre-designed document that displays the financial transactions and balances associated with a bank account over a specific period of time. It serves as an official record of the account holder’s financial activities and is typically issued by the bank on a monthly basis or upon request. The bank statement template contains essential information that allows the account holder to track and manage their finances effectively.

Key components of a bank statement template include:

- Account Information: This section includes details such as the account holder’s name, account number, and the statement’s period (start and end date).

- Beginning and Ending Balances: The template shows the balance in the account at the beginning of the statement period (opening balance) and the balance at the end of the period (closing balance).

- Transaction History: The bulk of the bank statement template comprises a list of all transactions during the statement period. These transactions can include deposits, withdrawals, transfers, payments, and any other activity related to the account. Each transaction is usually accompanied by a date, description, and the amount involved.

- Debits and Credits: Transactions are categorized as either debits (withdrawals or expenses) or credits (deposits or income). This categorization helps the account holder understand the nature of each transaction and how it affects the account balance.

- Service Charges and Fees: If the bank charges any service fees, such as monthly maintenance fees or transaction fees, these will be listed separately in the statement.

- Interest Earned: For interest-bearing accounts, the template may include information about the interest earned during the statement period.

- Overdrafts and Returned Items: If there were any overdrafts or returned checks during the period, the bank statement will reflect these events.

- Running Balance: Some bank statement templates also provide a running balance column, which shows the account balance after each transaction, making it easier for the account holder to track the balance over time.

Using a bank statement template can be very beneficial for individuals and businesses alike. It provides an organized summary of financial activities, which can be used for various purposes, including budgeting, reconciling accounts, preparing tax returns, and verifying transactions.

However, it’s crucial to ensure that the information on the bank statement template matches your records and that you regularly review your statements to detect any errors or unauthorized transactions. Being aware of your financial transactions helps you maintain financial security and make informed decisions about your money.

Using a bank statement template offers several benefits for individuals and businesses alike. Here are some advantages:

- Organization and Clarity:

- A well-designed bank statement template helps organize financial transactions in a clear, structured manner. It provides a visual snapshot of income, expenses, and balances.

- Time-Saving:

- Templates eliminate the need to create a statement from scratch each time. You can simply input your financial data into the predefined fields, saving time and effort.

- Accuracy and Consistency:

- Templates help ensure that financial information is recorded consistently. This reduces the risk of errors or discrepancies in calculations.

- Customization:

- Templates can be tailored to suit specific needs, allowing you to include or exclude particular categories or details based on your preferences.

- Professional Appearance:

- A well-designed template gives your bank statement a professional look. This is particularly important for businesses when presenting financial information to stakeholders or clients.

- Compliance and Record Keeping:

- Using a template helps ensure that your statements comply with legal and regulatory requirements. It also aids in maintaining organized financial records for auditing or tax purposes.

- Analysis and Budgeting:

- Bank statement templates often include features for categorizing expenses. This makes it easier to analyze spending patterns and create budgets for better financial management.

- Easy Reconciliation:

- A template can simplify the process of reconciling your bank statement with your accounting records. It provides a clear structure for comparing transactions.

- Financial Planning:

- A well-maintained bank statement template helps in making informed financial decisions. It allows you to track your cash flow, identify areas for potential savings, and plan for future expenses.

- Improved Communication:

- For businesses, a clear and organized bank statement is crucial when communicating financial information to stakeholders, investors, or financial institutions.

- Saves Costs:

- Using a template can be more cost-effective than purchasing specialized software or hiring a professional to create custom statements.

Item specifics :

- MS Word.

- Instant Delivery & Download.

- Easy to edit, Easy to use.

- Template is 100% Customizable.

Terms :

- The responsibility of using any such item purchased from this site lies solely with the customer. I, the purchaser, agree that I will not use this site for any illegal purposes.

Reviews

There are no reviews yet.