Description

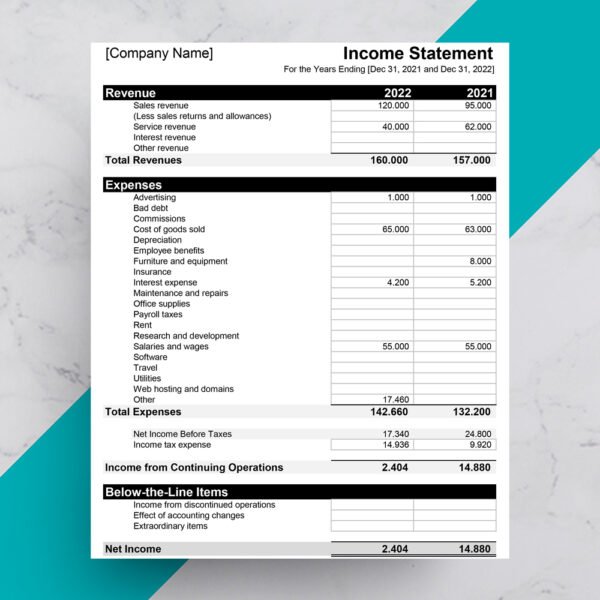

Income Statement Template

An Income Statement Template, also known as a Profit and Loss Statement, is a crucial financial document that provides a summary of a company’s revenues, expenses, and profits (or losses) over a specific period of time, typically a month, quarter, or year. Here are some key points to consider when using or creating an Income Statement Template:

- Revenue Section:

- This section details all the revenues generated by the business during the specified period. It includes sales revenue, service income, interest, and any other sources of income.

- Cost of Goods Sold (COGS):

- COGS represents the direct costs associated with producing or delivering the products or services sold by the company. This includes costs like raw materials, direct labor, and manufacturing overhead.

- Gross Profit:

- Gross profit is calculated by subtracting the Cost of Goods Sold from the total revenue. It reflects the profitability of the company’s core operations.

- Operating Expenses:

- This section includes all the expenses incurred in running the day-to-day operations of the business. It encompasses items like salaries, rent, utilities, marketing, and administrative costs.

- Operating Income (Operating Profit):

- Operating income is derived by subtracting the total operating expenses from the gross profit. It represents the profit generated from the core operations of the business.

- Other Income and Expenses:

- This category encompasses any additional sources of income or expenses that are not directly related to the core operations. It may include interest income, gains or losses from investments, and other non-operating items.

- Income Before Taxes:

- This figure is obtained by adding or subtracting other income and expenses from the operating income. It represents the company’s profit before taxes are accounted for.

- Income Tax Expense:

- This section records the taxes owed by the company based on its taxable income. The applicable tax rate is applied to the pre-tax income.

- Net Income (Net Profit or Net Loss):

- Net income is the final figure on the Income Statement. It represents the company’s total profit (or loss) after all expenses, including taxes, have been accounted for.

- Earnings Per Share (EPS):

- For publicly traded companies, EPS is a crucial metric that indicates the portion of profit attributable to each outstanding share of common stock.

- Comparison and Analysis:

- The Income Statement is often compared with previous periods or industry benchmarks to assess the company’s performance and profitability trends.

- Accrual Basis vs. Cash Basis:

- The Income Statement can be prepared on an accrual basis (recognizing revenue when earned and expenses when incurred) or a cash basis (recognizing revenue when received and expenses when paid).

An accurately prepared Income Statement Template is vital for understanding a company’s financial performance, making informed business decisions, and providing valuable information to stakeholders, investors, and creditors.

Item specifics :

- MS Excel.

- Instant Delivery & Download.

- Easy to edit, Easy to use.

- Template is 100% Customizable.

Reviews

There are no reviews yet.