Description

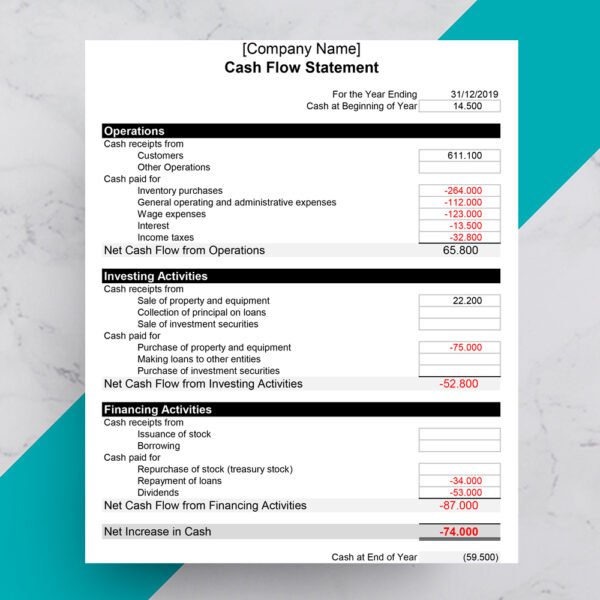

Cash Flow Statement Template

A Cash Flow Statement Template is a financial document that provides a detailed breakdown of an organization’s cash inflows and outflows over a specific period of time. It is a critical tool for assessing the liquidity and financial health of a business. Here are some key points to consider when using or creating a Cash Flow Statement Template:

- Operating Activities:

- This section records cash transactions related to the core operations of the business. It includes receipts from customers and payments to suppliers, employees, and other operational expenses.

- Investing Activities:

- This section covers cash flows related to the acquisition and disposal of long-term assets. It includes purchases or sales of property, equipment, investments, and other assets.

- Financing Activities:

- This section focuses on cash flows related to the business’s capital structure. It includes activities such as issuing or repurchasing stock, obtaining or repaying loans, and paying dividends to shareholders.

- Net Cash Flow:

- The Cash Flow Statement calculates the net cash flow by summing up the cash flows from operating, investing, and financing activities. This figure represents the change in cash position during the period.

- Opening and Closing Cash Balance:

- The statement typically begins with the opening cash balance (the amount of cash on hand at the start of the period) and ends with the closing cash balance (the amount of cash on hand at the end of the period).

- Cash Equivalents:

- Cash equivalents, such as highly liquid investments with short maturities, are often included in this statement. They are treated as cash for the purpose of cash flow reporting.

- Direct vs. Indirect Method:

- The Cash Flow Statement can be prepared using either the direct method (which lists actual cash receipts and payments) or the indirect method (which adjusts net income for non-cash items and changes in working capital).

- Non-Cash Transactions:

- Some transactions, such as depreciation and amortization, do not involve the actual exchange of cash. These are recorded separately to reconcile net income with cash flow.

- Cash Flow Ratios:

- Analyzing ratios derived from the Cash Flow Statement, such as the cash flow margin or cash flow to debt ratio, can provide insights into the financial stability and liquidity of the business.

- Historical vs. Projected Cash Flow:

- Cash Flow Statements can be prepared for historical periods or projected for future periods. Projected cash flow statements are valuable for financial planning and forecasting.

A well-prepared Cash Flow Statement Template is essential for financial planning, budgeting, and assessing the cash position of a business. It helps management make informed decisions regarding investments, financing, and day-to-day operations.

Item specifics :

- MS Excel.

- Instant Delivery & Download.

- Easy to edit, Easy to use.

- Template is 100% Customizable.

Reviews

There are no reviews yet.